MILC — Tokenize The Media Industry

The Creator Economy was already disrupted in the Web2 era. But the disruption has not stopped. Rather, it has made its way into the Web3 era.Media industry inefficiencies in content distribution supply chain result in exorbitant costs that are 30 to 50% higher. To solve this, we have Media Industry Licensing Content (MILC), a project that aims to tokenize the media industry.

MILC will solve the disorganization of the industry by

- Making video content globally available

- Better discovery for buyers

- Solving licensing processes

- And speeding up the feedback cycle

In nutshell, it envisions becoming a bridge between the audience and the content creators, buyers, and distributors. Furthermore, it wishes to bring down the number of intermediaries in the content distribution and licensing processes.

Team Behind the Project

Many new crypto projects are started by young founders; however, MILC is an initiative of an industry veteran called Welt der Wunder TV. The company has been active since 1996. It is one of the top media players in Germany that happens to be one of the largest TV markets in the world.

The same team that leads the company is also involved in MILC project. At the helm is, Hendrik Hey the Founder of Welt der Wunder and now MILC. His deputies are Eugen Nussbaum the Business Director and Esther Hey the Head of Sales.

Accolades to Welt der Wunder’s name are the Bavarian TV Award and nominations for Grimme-Award and German TV Award.

Its industry dominance is also evident in the number of users it has at 5 million monthly viewers through TV broadcasting, and 5–10 million monthly online viewers.

In 2020, audit firm Ernst & Young valued the media repository of the company at €48 million. So the team holds vast experience and has also braved recessions earlier. Therefore, they may be able to withstand the ongoing bear market too.

MILC Main Offerings

MILC is an attempt to defragment the global content distribution market and establish some sort of international licensing standards. This would be realized by establishing a global content marketplace powered by blockchain and Artificial Intelligence (AI) technologies called the Content and Media Hub. Its offerings include marketing, rights management, contracting, and delivery of content.

The marketplace will manage the metadata of a license.

So, in a matter of just clicks the content can be shared across the globe on this platform.

MILC will earn a 10% fee on each successful sale. A peculiar quality is that the platform fee will reduce with utilization. The more it is utilized, the lesser will be the fee. MILC will also provide standardized license agreements which would be free, covering around 70% to 80% of the cases and resulting in lesser legal costs.

- License Violations

Violation of license is not unusual. It happens frequently. Sometimes the violation is unintentional as the TV station/channel may not be able to remove a piece of content on the expiry date due to the long processes. They may breach the license by a few days and take the content off the platform.

In this situation, the channel may have to pay the same license fee again. It could be done inadvertently and causes unnecessary expenses to the channel in case it doesn’t wish to extend the license for a long period.

Another case of violation is intentional. Here the licensee may violate the agreement hoping that the licensor may not get to know. MILC has a warning system that warns both parties in time.

Market Potential

MILC claims that it can solve the problems of a $500 billion license market. Over 6000 TV stations are there in the world with many emerging regional streaming platforms and over-the-top (OTT) services.

Media Licensing Token (MLT)

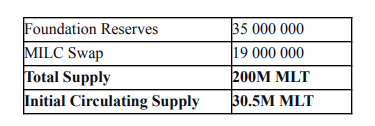

MLT is the utility token of MILC platform that helps to disintermediate and shorten the licensing processes. This can execute contract signature, approval, and payment in a matter of clicks. Its supply is capped at 200 million tokens.

The primary use cases of MLT are:

- Platform operation payments: For all the operations like licensing and content distribution, MLT may be used as the preferred payment currency in the MILC ecosystem. Fiat currencies may also be supported but on the platform, it would be compulsory to use MLT.

- Ecosystem governance: All the updates and upgrades to the platform will be decided by the community, i.e., the MLT holders. So, the token will play a key role in facilitating such operations.

Governance also include voting on early script drafts, casting proposals, trailer sneak peaks from content producers, studios, marketers, etc. Votes will be weighted in proportion to the MLT holding size, where 1 MLT = 1 Vote.

- Content Launchpad: The Launchpad would enable content creators to fundraise for their projects. In these fundraisers, the MLT holders would be the investors. MILC would bring together TV channels and producers at the table wherein the former may propose ideas for content. These producers and MLT holders can then support the ideas.

- Staking: The staking program is aimed at promoting long term MLT holding by providing rewards. It has different APY in different pools on Uniswap and Pancakeswap powered by Ferrum Network and Mantra DAO. They are providing APY between 50% to 308%.

Token Burns

Every purchase made by MLT token will result in 0.5% of the value being burned. This burn rate may be changed in future. Token burns will continue till just 100 million MLT are remaining.

Buybacks

MILC would buy back MLT whenever a fiat-to-token swap occurs. This would create demand even when the secondary markets are not seeing much trading.

These tokens would be allocated to new partners from the industry so that don’t face any hassles. The redistribution would result in more equitable holdings among the industry players and a sustainable onboarding of new players.

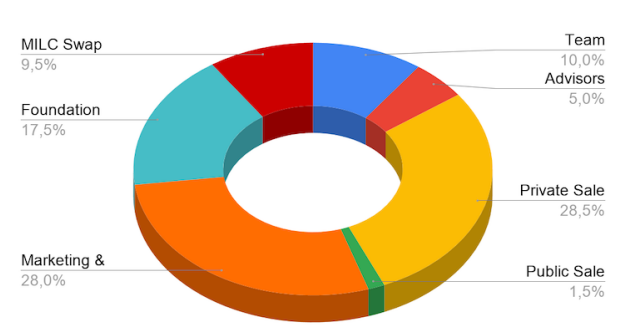

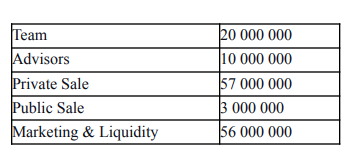

MLT Distribution

MILC Metaverse

This metaverse is curated for the media industry. In this metaverse, content creators and businesses would interact with each other.

It has specific places for specific operations such as Content Palace which is a marketplace where media professionals can, Exchange where you can exchange crypto, etc. This metaverse has many more features replicating the real world.

It also has its own community platform called the MILC Community.

Roadmap

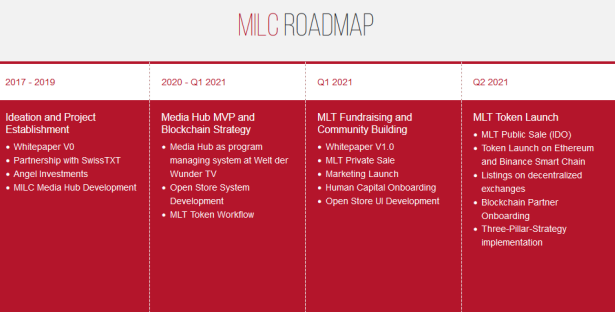

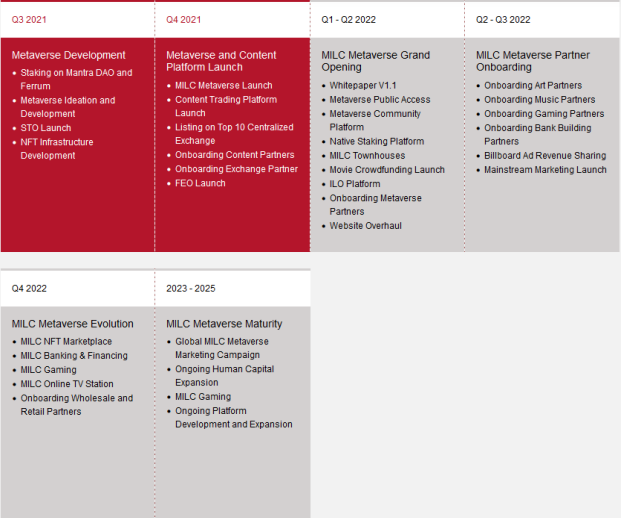

The project began in 2017 and since then it has come a long way.

Most of the ecosystem is geared towards catering to the B2B segment. But it has plans for the B2C segment as well through Augmented Reality (AR), Virtual Reality (VR), and video content.

Some Flaws to Watch Out For

The project may favor the early adopters as it has had a private sale and also the voting power favors the accumulators. This also means that the whales would get an unusually high amount of power. This must be corrected as more players join the ecosystem they may not feel empowered.

The project feels too grand to come to fruition in the short term. A global licensing standard means all the governments coming together and signing it. Unifying the whole industry is difficult. Firstly it should capture the European market where it is actually based. European Union has unified economic laws.

Conclusion

MILC should start partnering with big OTT players like Amazon, Netflix, etc. These platforms have massive communities which cannot be overlooked. Also, they have good experience in optimizing the feedback loop. Furthermore, unifying the regional players is difficult so these global players should be targeted first as they cater to both regional and global audiences.

MILC is one of the Web3 projects which offers real-world utility. It is not just a crypto project that stays on-chain as it has more to do with off-chain activities.

The vision is quite grand and may take a lot of time to be crystallized. Till then, it will remain like a hidden gem.

Follow me on Medium to not miss any threads (it’s free): cevo

DISCLAIMER: Any opinions, news, research, analyses, prices, or other information contained on cryptocevo is provided as general market commentary and does not constitute investment advice. Cryptocevo, partners, or contributors will not bear any liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

0 Comments