The world’s largest cryptocurrency exchange suffered a run-on withdrawals of over $3.6 billion in a suspected FTX fiasco redux!

On

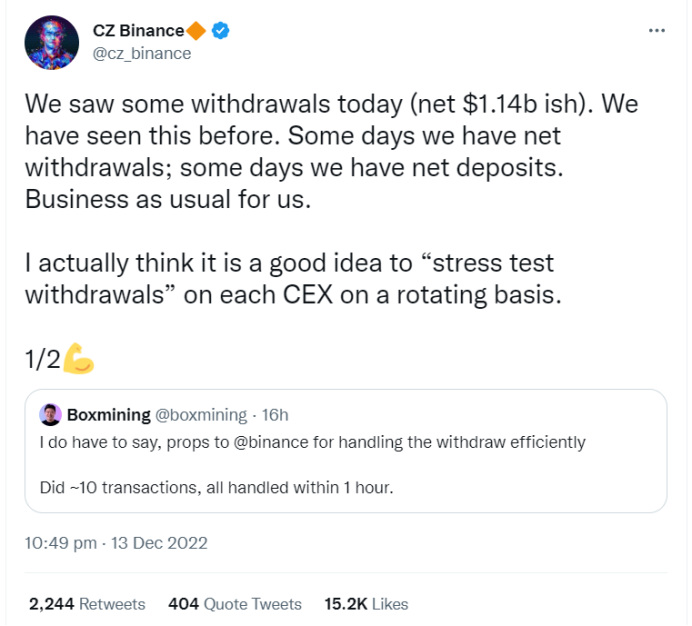

It is worth noting that on December 13, Binance had an outflow of nearly $2 billion, a single-day outflow scale nearly 18 times that of the second-place Bitfinex.

Even, Cryptocurrency once opened a coin withdrawal pause in the middle of the day, leading to the spread of panic. Crypto market users who just experienced the FTX collapse fiasco and the misappropriation of user funds fiasco are obviously extra sensitive to such things.

At present, the withdrawal of coins by CoinSec has temporarily resumed normal. Binance founder Zhao Changpeng’s response to the matter.

Cryptocurrency founder Zhao Changpeng has been expressing his confidence in the company’s outlook on Twitter for several days, and even tweeted for several days after the incident to boost market confidence.

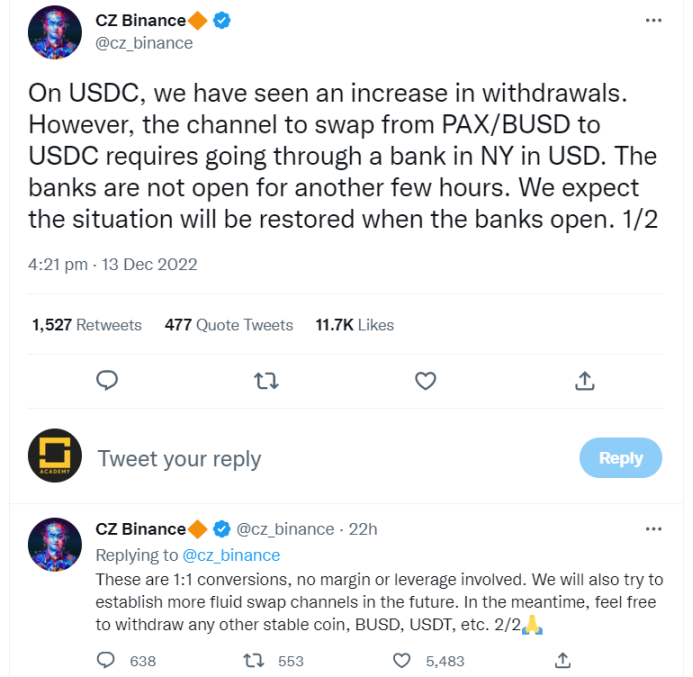

At 16:21 PM on the 13th, Binance founder Zhao Changpeng responded to the incident for the first time, CZ pointed out: Since the channel of PAX and BUSD conversion to USDT needs to go through the New York bank’s USD account, it must be done only during the bank’s business hours, and the situation is expected to resume when the bank opens in a few hours. In the meantime, their conversion is 1:1 no margin or leverage involved, and in the future will try to establish a more fluid exchange channel, currently, BUSD and USDT withdrawals are normal and can always reflect any other stablecoin, BUSD, USDT, etc.

At 10:49 pm on the 13th, the founder of Coin Security, Zhao Changpeng, tweeted again on the matter, saying that the incident was only equivalent to doing a “stress test withdrawal.”

At 12:19 on the 14th, Zhao Changpeng tweeted again that things had stabilized and that yesterday was not the highest withdrawal we handled, not even the top 5. We processed more during the LUNA or FTX crashes. Deposits are now back up.

The latest response from Zhao Changpeng at 13:57 on the 14th said. This stress test helps to improve the credibility of CoinSec.

Market Reaction.

The outflow of funds from cryptocurrency exchanges is being closely watched by the market, with fears of a possible domino effect in the cryptocurrency space, following the bankruptcy of FTX and the arrest of its founder Sam Bankman-Fried. There have been allegations that FTX illegally misappropriated customer funds and that the company’s creditors could be as high as 1 million, shaking trust in cryptocurrencies as an entire industry.

This is the main reason why the Cryptocurrency incident received so much attention, but the market still has some doubts about Cryptocurrency’s capital reserves, because, at the time of this incident, Sun Yuchen and Wintermute injected nearly $300 million into Cryptocurrency before and after. If Binance’s capital reserve is really more than 100%, why does it need foreign aid in the face of a run?

This is a question worth thinking about, but for Binance, which has temporarily survived the crisis, these market doubts will also eventually become an unresolved mystery!

So, facing the risk of misappropriation of user funds similar to the FTX incident, the safest thing is always to segregate funds and for users to keep them by themselves, which is the solution provided by SuperEx in the face of user fund security risks.

SuperEx offers three major solutions to FTX-style risks.

Internal authorization: SuperEx supports the Wallet Connection protocol, which supports one-click authorization transactions for any wallet, ensuring the freedom and anonymity of decentralization and creating a safe and private transaction environment for users.

Information on the chain: SuperEx supports transaction information on the chain, and transaction information can be publicly accessed on the blockchain and cannot be tampered with, making transaction information secure and transparent.

Super Wallet: SuperEx Wallet is a layered deterministic wallet that supports multiple chains and has achieved perfect interaction with the trading side of SuperEx, providing “asset isolation” for SuperEx, so that no matter what irresistible factors are experienced, the user’s crypto assets on Super Wallet will not be touched. SuperEx may not be the largest crypto asset but it is certainly one of the most secure platforms.

0 Comments